FAB Online Banking: Manage Your Finances Anytime

FAB Online Banking: Everything You Need to Know

Focused on the needs of individuals and businesses, all of the digital services offered by FAB are the combination of innovation and human-friendly functionality, so they’re the first choice of millions of people. Paying bills, transferring money, or managing investments, FAB Online Banking makes your life smooth and saves time, as well as promotes financial decision-making. As the bank industry changes in 2025, FAB remains innovative, securing customers always ahead with easy to use, efficient, and safe tools.

This guide investigates the details and specifics of FAB Online Banking, its main features, registration procedures, and advantages, as well as the safety rules. We shall go through some of the most frequent problems and offer solutions as well as give answers to some of the widely asked questions so that you can take full advantage of banking. This guide will provide you with everything you need to know about using FAB so that you get the best from digital banking.

What is FAB Online Banking?

FAB Online Banking is the online banking system that First Abu Dhabi Bank provides so that its clients could control their finances anywhere and at any time. The platform, which is accessible through web browsers or the FAB Mobile Banking App, connects a thorough variety of banking services, including managing accounts, and keeping tabs on investments, into one, intuitive interface. Designed to the highest safety standards and to serve the needs of diverse customers in the UAE, FAB Online Banking gives customers the convenience of transacting business, checking balances, and following the progress of their accounts, as well as gaining access to personalized services and purchasing financial products.

Key Features of FAB Online Banking

The FAB Online Banking is full of features that would make managing the money easy, and such features ensure that it is safe and flexible. FAB has some fundamental features that are its core functionalities to become the leader in digital banking as we see below.

Account Management

FAB Online Banking enables people to check and control different accounts in real time. Customers can easily keep in touch with their savings, their current and their fixed deposit accounts, including the balances and viewing their transaction history. Such activities as reports with categorized spending money allow users to have an intelligent financial management. Account alerts by setting low balances or big transactions can also be provided thus you’re always in control.

Money Transfers

FABs platform has never been easy when it comes to the transfer of funds. Regardless of whether you want to transfer funds internationally or locally within the UAE, FAB allows instant payments in the UAE, cross-border transfers, as well as transfers to non FAB accounts. The service is connected to worldwide payment systems, and has a competent exchange rate and affordable costs. The latter is possible; the user can program recurring transfers, save beneficiary information, and institute faster transfers in the future.

Bill Payments

FAB Online Banking simplifies the payment on bills where consumers can pay their utility bills, mobile charges and credit card bills with the help of a few clicks. The site is made up of one time payments and recurring payments and the modes of payment are both out of your account or directly out of the card. Connection with all the major service providers in the UAE allows you to take care of all your bills in a single location and save your time and worries about delays in their payment.

Loan Management & Credit Card

FAB Online Banking makes it easy to manage credit cards and loans. Credit cards users can check balances, monitor the expenditure, and pay them instantly. The site further provides loan management options so that the customers can inquire about repayment dates, obtain new loans or get an extra allocation. Interest calculators and the available detailed statements are useful in ensuring that the users keep their financial house in order.

Investment Services

FAB online banking also offers investors access to a variety of investment products to those who are interested in increasing their assets. The customers will be able to access mutual funds, bonds and structured products and the market will be updated in real time as well as the tracking of the portfolios. The platform also provides individualized investment recommendations by the wealth management team of FAB ensuring that users can match their investments with their financial objectives.

Security Features

The issue of security is a priority at FAB Online Banking. Multi-factor authentication (MFA), biometric login possibilities, and end-to-end encryption uphold the safety of user data in the platform. Secure sessions and real-time fraud detection together with safe session timeout guarantees secure transactions, whereas a variety of security options enables users to define transaction limits and get the alerts on suspicious activity.

Card Management

Using the FAB platform, consumers can deal easily with their debit cards and credit cards. It allows to enable or disable cards, to create and manage spending limits and to send card replacements online. Digital card integration with mobile wallets such as the Apple Pay and the Samsung Pay is also enabled on the system, allowing contactless payments as well.

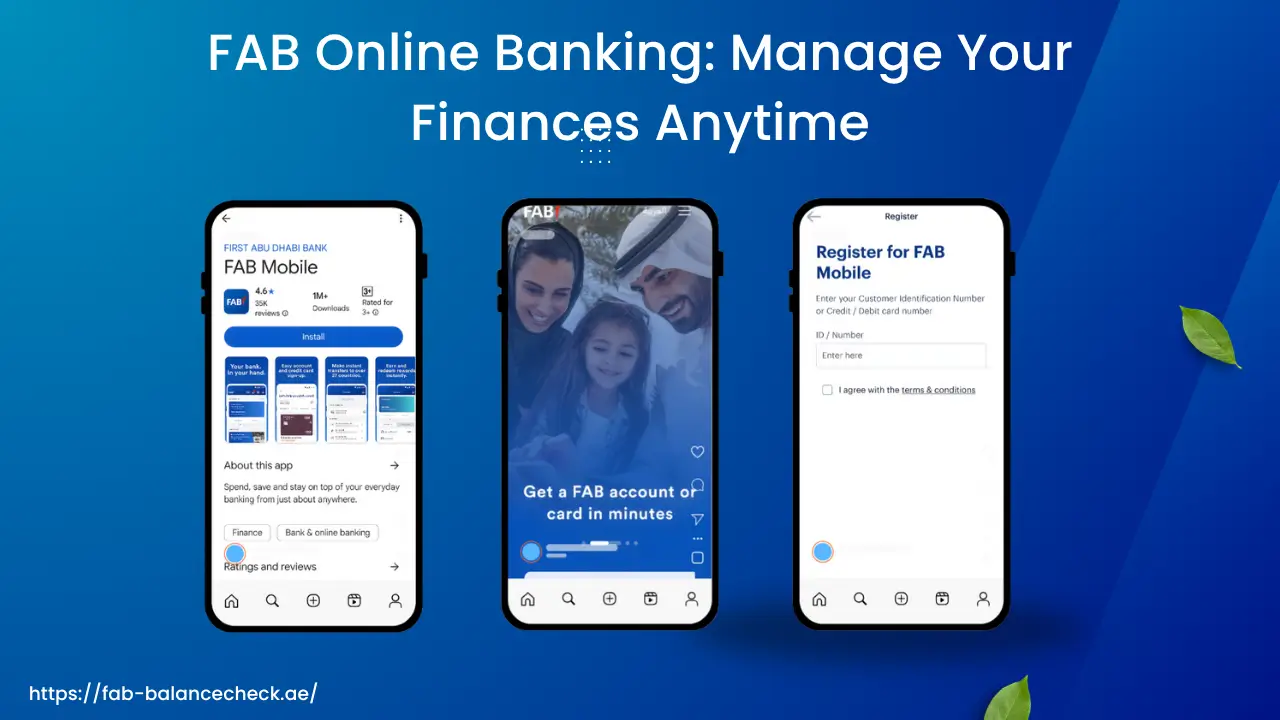

Banking Application -Mobile

FAB mobile banking application produced in conjunction with the online service provides all the features in mobile-friendly presentation. The app runs on both iOS and android, but it contains some exclusive functionalities such as voice command, augmented reality (AR) used to locate an ATM, and account-update push notifications. It has a user-friendly interface, which makes it usable on the move.

How to Register for FAB Online Banking?

Getting started with FAB Online Banking is straightforward. Follow these steps to register:

- Visit the FAB Website or App: Go to the official FAB website (www.bankfab.com) or download the FAB Mobile Banking App from the App Store or Google Play.

- Access the Registration Portal: Click on the “Register for Online Banking” option on the website or app.

- Enter Your Details: Provide your FAB account number, Emirates ID, or debit/credit card details. You’ll also need your registered mobile number for verification.

- Verify Your Identity: Receive a one-time password (OTP) via SMS or email to confirm your identity.

- Set Up Login Credentials: Create a username and a strong password. You may also enable biometric login for added convenience.

- Complete Registration: Agree to the terms and conditions, and your account will be activated for online banking.

Once registered, you can log in to access all services. Ensure your contact details are up to date to avoid interruptions.

How to Use FAB Mobile Banking App?

The FAB Mobile Banking App is designed for intuitive navigation and robust functionality. Here’s how to make the most of it:

- Download and Log In: Install the app from your device’s app store and log in using your online banking credentials or biometric authentication.

- Explore the Dashboard: The app’s homepage provides a snapshot of your accounts, recent transactions, and quick access to key features.

- Perform Transactions: Navigate to sections like “Transfers,” “Bill Payments,” or “Card Management” to complete tasks. Use the search bar or voice commands for faster access.

- Set Up Notifications: Enable push notifications to receive real-time updates on transactions, bill due dates, or security alerts.

- Use Advanced Features: Try AR-based ATM locators, schedule recurring payments, or access investment tools directly from the app.

- Contact Support: Access 24/7 customer support via live chat or call directly from the app for assistance.

Regular updates ensure the app remains secure and feature-rich, so keep it updated for the best experience.

Top Benefits of FAB Online Banking

Top Benefits of FAB Online Banking

FAB online banking has a lot of benefits attached to it that make your banking experience better. The following are the best advantages:

- Convenience: Access and handle all your banking requirements at any time and anyplace, 24/7, even without the need to visit any branch.

- Time-Saving: Perform tasks such as transfers and bills payment within seconds.

- Real-Time Insights: View the current account balances, transactions, and receiving spent analysis.

- Affordable: Pay low or zero charges on most of the transactions, particularly local funds transfer and bill payments.

- Global Access: Make international transactions and accounts management when travelling.

- Personalized Services: Enjoy the advantage of personalization of investment advice and financial planning tools.

- Fraud and Encryption: Superior monitoring and vouching of fraud ensures the security of your money and information.

- Mobile Integration: Switch to the FAB Mobile Banking App to get on moving banking.

Security Tips for FAB Online Banking

UsTo have a safe banking experience, use the following vital tips on security:

- Make Use of Good Passwords: Develop a complicated password of letters, numbers, and symbols. A secret not to be used is something that can be easily guessed such as your birthday.

- Turn on Multi-Factor Authentication: By turning on MFA, you would receive an additional security level during log-on.

- Avoid public Wi-Fi: Use secure networks only when doing transactions instead of vulnerable public Wi-Fi networks so that the data might be intercepted.

- Keep an Eye On The Account: Check the regular activity on your account and fix the alert to suspect this.

- Include Current Contact Information: Your phone number and email is important to remember to get OTPs and notifications.

- Watch out on Phishing: Do not share your log in details or OTPs through emails, text messages, or calls. FAB will not need to demand such information.

- Log Out And Quit: When you finish using the platform always log out or quit the platform especially on shared machines.

- Maintain Software Updates: Make sure your browser, app and device are up to date to eliminate vulnerabilities.

FAB Online Banking Customer Support

| Service | UAE Contact | International Contact | Email Support |

| General Customer Support | 600 52 5500 | +971 2 6811511 | [email protected] |

| Digital Banking Support (Mobile App & Online Banking) | 600 52 5500 | +971 2 6811511 | [email protected] |

| Payit Digital Wallet Support | 600 543329 | +971 2 4996411 | N/A |

| Corporate Banking Support | +971 2 4105101(Abu Dhabi) /+971 4 3710400 (Dubai) | N/A | [email protected] |

| Trade Finance & Business Banking Support | +971 4 6079722 | N/A | [email protected] |

| Elite Banking Support | 800 40000 | +971 2 4103402 | [email protected] |

| Private Banking Support | 800 40000 | +971 2 4996599 | [email protected] |

| Investor Relations | N/A | N/A | [email protected] |

| WhatsApp Support | +1 704 771 0476 | N/A | N/A |

Issues with Solutions

The table below outlines common issues users may encounter with FAB Online Banking and their solutions:

| Issue | Description | Solution |

| Login Failure | Unable to log in due to incorrect credentials or OTP issues. | Verify your username and password. Request a new OTP and ensure your registered mobile number is active. Contact FAB support if the issue persists. |

| Transaction Delays | Transfers or payments take longer than expected. | Check your internet connection and confirm beneficiary details. For international transfers, verify SWIFT codes. Contact FAB for status updates. |

| App Crashes | FAB Mobile Banking App freezes or crashes during use. | Update the app to the latest version. Clear cache or reinstall if necessary. Ensure your device meets the app’s system requirements. |

| Account Locked | Account access is restricted after multiple failed login attempts. | Use the “Forgot Password” option to reset credentials. Contact FAB’s customer service to unlock your account after verification. |

| Payment Errors | Bill payments or transfers fail due to insufficient funds or technical issues. | Verify account balance and transaction limits. Retry after a few minutes or contact FAB for assistance with error codes. |

FAQs

Conclusion

The FAB Online Banking has the ability to cut across all areas, being strong, safe and easy to operate in its own dealing with the various needs of the contemporary banking customers. It has all characteristics such as real time account management, smooth transfer of money and investment tools also available which puts users in the position to control their finances hassle free.

The FAB Mobile Banking App also provides a fuller access, through proposing new functions, such as the use of the AR to locate ATMs and voice commands. With the security tips and solutions offered one can make the most of the experience and leave his or her accounts secure.

Digital banking is going to be the order of the day in 2025, and FAB will still be a favored partner to millions of customers in the UAE and globally. As a newbie or an experienced participant, FAB Online Banking has the resources and the opportunities to save easily, and make your money run the right way. Join now, discover and experience all that it has to offer and transform the benefits of digital banking with FAB.