FAB (First Abu Dhabi) Bank Balance Check Via SMS, ATM & App — Complete Details

The ability to control your financial situations begins with control of your bank balance. First Abu Dhabi bank (FAB), the largest and the most credible bank in the UAE, is available at your service anytime you need to know your account balance, wherever you are; at home in the UAE, or in other countries.

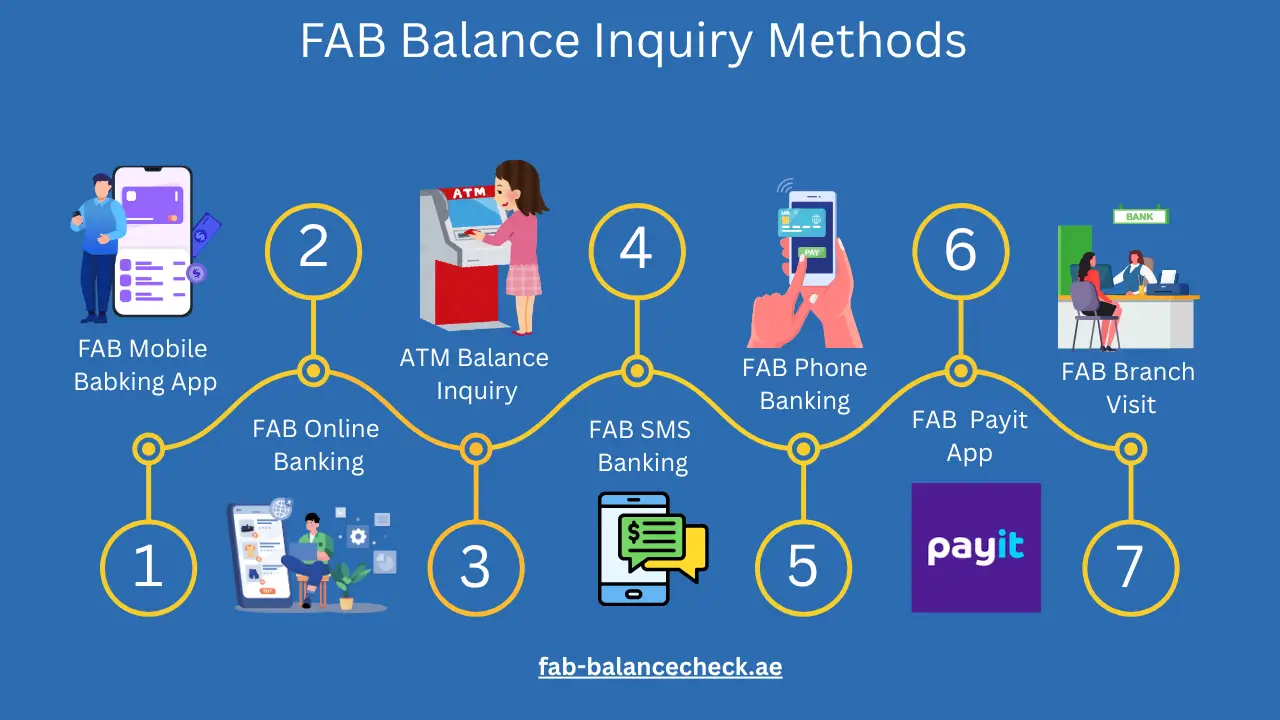

This detailed Tentative guide to 2025 FAB Bank balance check will take you through various options of checking your balance of the FAB bank through the FAB Mobile Banking App, FAB (First Abu Dhabi) online banking, FAB ATMs, FAB SMS, FAB phone banking, FAB Payit App, FAB branching. We will also discuss checking the balance of prepaid cards and Ratibi, the advantages of doing regular checking, how to subscribe/register to the online banking service and also the common mistakes and how to troubleshoot them. Well, let us jump in so that you can easily seize control over your finances!

What is First Abu Dhabi Bank (FAB)?

First Abu Dhabi Bank (FAB) is a leading institution of financial services in the UAE and was founded in 2017 following the merging of First Gulf Bank (FGB) and National Bank of Abu Dhabi (NBAD). Known as an innovative provider of digital banking solutions and having a wide network, FAB provides services to both individuals and corporate clients with savings, credit cards, and prepaid Ratibi cards among others.

To budget, prevent overdrafts, and detect illegal transactions at the initial stages, it’s vital to control FAB (First Abu Dhabi) account balance on a regular basis. Enjoying the FAB easily accessible platforms will allow you to check your balance anywhere in the world and the mode of transfer will be at your convenience.

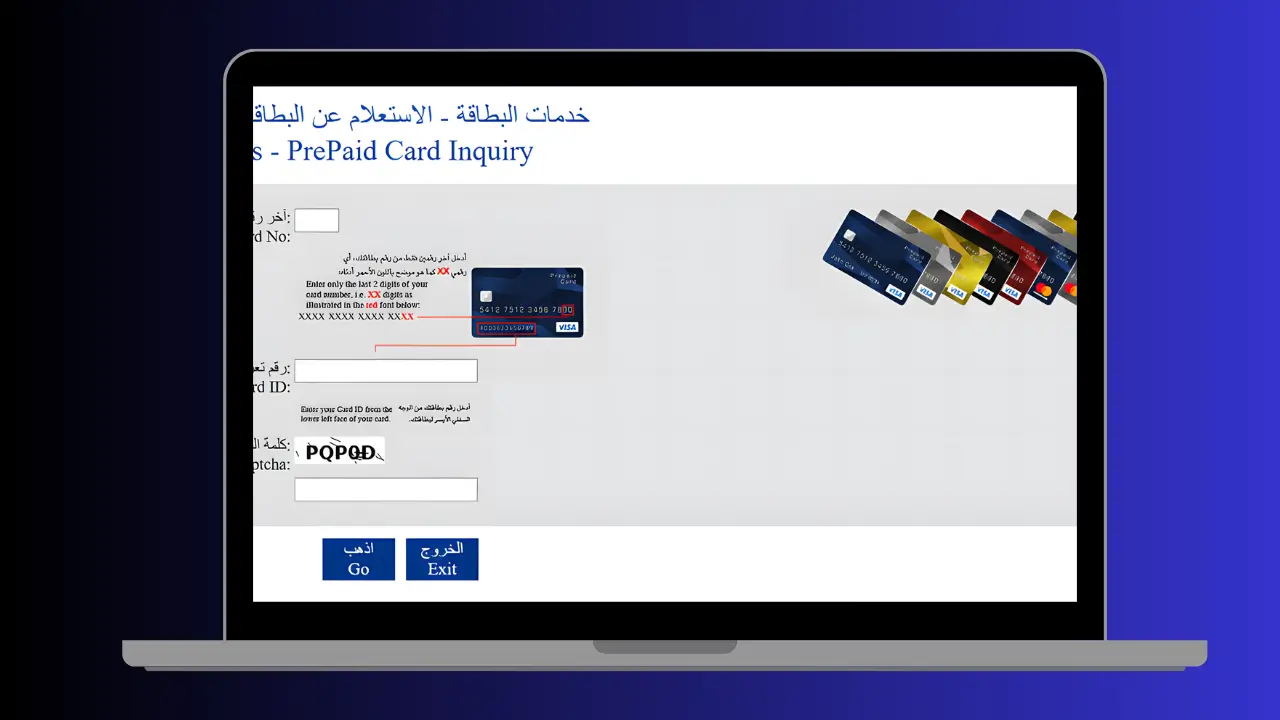

FAB (First Abu Dhabi) Balance Check | Card Services – PrePaid Card Inquiry

خدمات البطاقة – الاستعلام عن البطاقة المدفوعة مسبقاً

Card Services – PrePaid Card Inquiry

How to Check Your FAB Balance?

FAB provides various methods of account balance verification, so all the customers can be flexible and always get access to their accounts. It’ll be divided into simple, followable steps of each approach listed below so you can manage your finances at the top of your mind.

List of All FAB Balance Enquiry Methods in UAE:

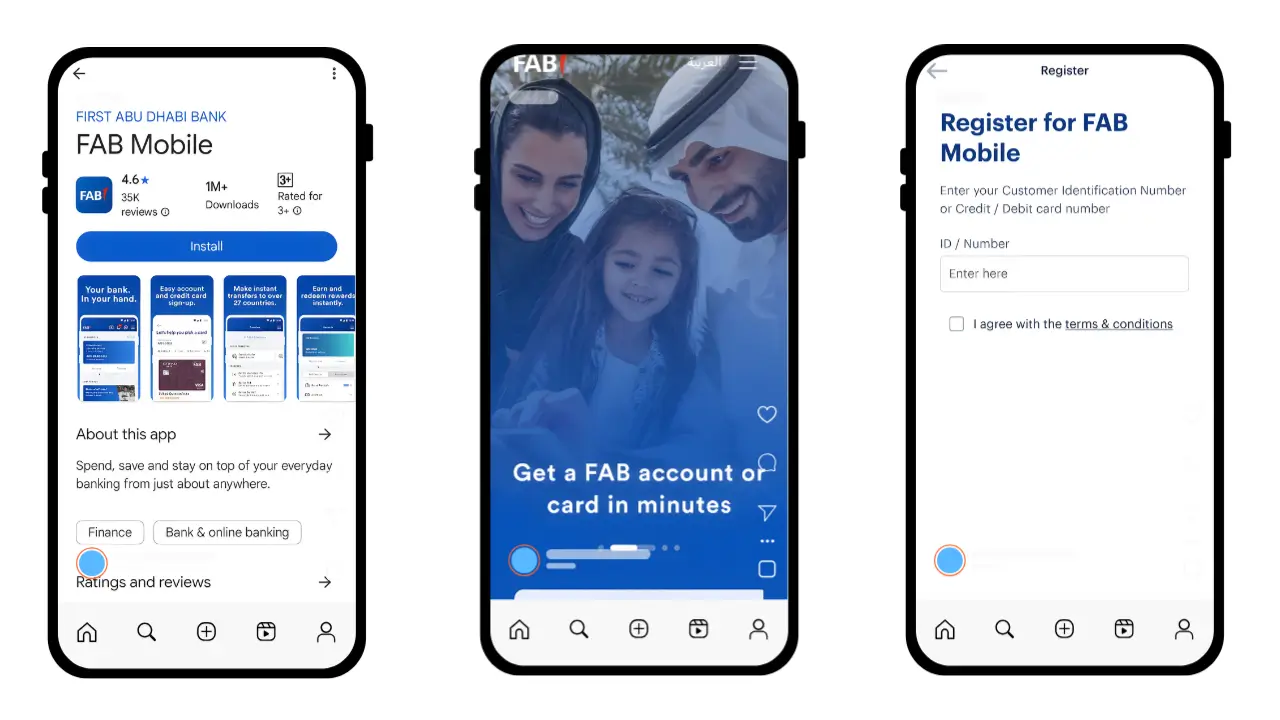

1. Check FAB (First Abu Dhabi) Balance Using Mobile App

The FAB Mobile Banking App is one of the most convenient and secure ways to check your balance. Available on iOS and Android, the app allows you to view your account details, transfer funds, and manage cards with just a few taps.

Steps to Check Balance:

- Download the App: Search for “FAB Mobile” in the App Store (iOS) or Google Play Store (Android) and install it.

- Log In: Open the app and sign in using your username and password. If you’re a new user, register using your Emirates ID and card details.

- View Balance: Once logged in, your account balance will be displayed on the homepage. Tap on your account to view recent transactions or e-statements.

- Enable Notifications: Set up balance alerts in the app’s “Alerts” section for real-time updates.

Why Use It? The app is secure, with fingerprint or Face ID login options, and offers real-time access to your accounts, making it ideal for tech-savvy users.

2. How to Check Your FAB Balance Online (Official Website)

FAB’s online banking portal provides a comprehensive platform to manage your finances from a computer or laptop, perfect for users who prefer a larger screen or detailed transaction history.

Steps to Check Balance:

- Visit the Portal: Go to www.bankfab.com and click “Login” in the top-right corner.

- Sign In: Enter your username and password. If you’re not registered, follow the prompts to sign up using your customer ID or card number.

- Access Accounts: Navigate to the “Accounts” section to view your balance and transaction history.

- Download Statements: Click on “Download E-statement” for detailed records.

Why Use It? Online banking is ideal for users who want to manage multiple accounts, download statements, or perform complex transactions from home.

3. Check FAB Balance via SMS Banking

FAB’s SMS banking service is a fast, internet-free way to check your balance, ideal for users with limited data or those in areas with poor connectivity.

Steps to Check Balance:

- Register for SMS Banking: Ensure your mobile number is linked to your FAB account. Register via the FAB Mobile App or at a branch.

- Send SMS: Text “BAL” followed by the last 4 digits of your account number to 2121 (e.g., “BAL 1234”).

- Receive Balance: You’ll receive an SMS with your current balance instantly.

Why Use It? SMS banking is quick, doesn’t require a smartphone, and works internationally if your number is registered.

4. How to Check Your FAB (First Abu Dhabi) Balance Using an ATM

For those without internet access or who prefer offline methods, FAB’s extensive ATM network allows quick balance checks using your debit, credit, or prepaid card.

Steps to Check Balance:

- Locate an ATM: Find a FAB ATM or one within the Emirates NBD or UAE Exchange network using the branch locator on www.bankfab.com.

- Insert Card: Insert your FAB debit, credit, or Ratibi card into the ATM.

- Enter PIN: Input your 4-digit PIN.

- Select Balance Inquiry: Choose “Balance Inquiry” from the menu. Your balance will appear on the screen, with an option to print a receipt.

Why Use It? ATMs are reliable, available 24/7, and don’t require an internet connection, making them perfect for quick checks on the go.

5. Check FAB Balance via Phone Banking (Call Support)

For personalized assistance, FAB’s customer support team can help you check your balance over the phone.

Steps to Check Balance:

- Call FAB: Dial 600 52 5500 (UAE) or +971 2 6811511 (international).

- Verify Identity: Provide your customer ID, card number, or T-PIN as prompted by the automated system or agent.

- Request Balance: Follow the menu or ask the representative for your account balance.

Why Use It? Phone banking is ideal for users who prefer speaking to a representative or need assistance with complex queries.

6. Check FAB Balance via Payit Wallet App

The FAB Payit App is a digital wallet that integrates with FAB’s Ratibi card, offering a unique way to check your prepaid card balance and manage transactions.

Steps to Check Balance:

- Download Payit: Install the Payit app from the App Store or Google Play Store.

- Link Ratibi Card: Sign in and link your FAB Ratibi card to the app.

- Check Balance: Navigate to the card section to view your balance instantly.

Why Use It? The Payit app is perfect for Ratibi cardholders, offering additional features like bill payments and international transfers.

7. Check FAB Balance by Visiting a FAB Branch

For those who prefer in-person banking, visiting a FAB branch provides direct access to your account details.

Steps to Check Balance:

- Locate a Branch: Use the FAB branch locator on www.bankfab.com.

- Bring Identification: Carry your Emirates ID and FAB card for verification.

- Request Balance: Approach a teller or customer service desk to check your balance.

Why Use It? Branch visits are best for complex issues or when other methods are unavailable, though they require time and travel.

What Are the Best and Easiest Ways to Check Your FAB Account Balance?

To help you choose the most suitable method, here’s a comparison table of FAB balance check options:

| Method | Best For | Why It’s Good | Rating (⭐ out of 5) |

| 📱 Mobile App | Tech-savvy users, frequent checks | Most convenient, instant access, and secure | ⭐⭐⭐⭐⭐ |

| 💻 Online Banking | Detailed transaction management | Full account details, easy to use | ⭐⭐⭐⭐⭐ |

| 🏧 ATM | Offline access, quick checks | Quick and simple but needs a physical visit | ⭐⭐⭐⭐ |

| 📩 SMS Banking | Limited internet, basic phones | Works without internet, instant reply | ⭐⭐⭐⭐ |

| 📞 Phone Banking | Personalized assistance | Takes time but helpful if other ways fail | ⭐⭐⭐ |

| 💰 Payit Wallet App | Ratibi cardholders | Good for wallet users, but not for all | ⭐⭐⭐ |

| 🏦 Branch Visit | Complex issues, in-person banking | Slowest method, but useful if needed | ⭐⭐ |

Recommendation: The FAB Mobile App and SMS banking are the easiest and fastest methods for most users due to their accessibility and speed.

FAB Balance Check for International Users

If you’re outside the UAE, FAB ensures you can still check your balance seamlessly. Here’s a table summarizing options for international users:

| Method | Steps | Best For |

| Mobile App(Fastest) | Download the FAB Mobile App → Log in with customer ID & password → View balance on the home screen or under ‘Accounts’. | Quick & secure balance check anytime. |

| Online Banking(Best for Detailed Info) | Go to FAB Online Banking → Log in → Navigate to ‘Accounts’ → View balance. | Checking full account details. |

| Phone Banking(For Customer Support) | Call +971 2 6811511 → Follow IVR instructions or talk to a representative → Provide account details → Get balance. | If you need direct help from FAB. |

| SMS Banking(Fastest Without Internet) | Ensure SMS Banking is active → Send BAL [Last 4 digits of account] to FAB’s number → Receive an instant SMS with your balance. | Checking balance quickly without an internet connection. |

| ATM Check(For Travelers) | Use an international ATM that accepts FAB cards → Insert card → Enter PIN → Select ‘Balance Inquiry’ → View balance on the ATM screen. | Checking balance while traveling. |

How to Check FAB Prepaid & Ratibi Card Balance?

FAB’s prepaid and Ratibi cards are popular for employees earning up to AED 5,000, offering banking services without a traditional account. Here’s how to check their balances:

- Online Prepaid Card Inquiry Portal:

- Visit ppc.magnati.com/ppc-inquiry/.

- Enter the last two digits of your card number and the 13-digit Card ID.

- Click “Go” to view your balance instantly.

- FAB Mobile App:

- Log in to the FAB Mobile App and navigate to the “Cards” section.

- Select your prepaid or Ratibi card to view the balance.

- ATM:

- Insert your Ratibi or prepaid card into a FAB ATM.

- Enter your PIN and select “Balance Inquiry.”

- FAB Payit App:

- Link your Ratibi card to the Payit app and check your balance in the card section.

- Phone Banking:

- Call +971 2 6811511 (international) or 600 52 5500 (UAE) and provide your card details.

Top Benefits of Regular Bank Balance Checks

Constant monitoring of a bank balance is a very important step taken towards quality financial management. The posed advantages are the following:

- Prevent Overdrafts and Associated Fees: It helps you to know your balance so that you don’t spend more than you want and you are not charged extra because you are out of money.

- Identify Unauthorized Transactions: Checking your account on a regular basis will enable you to easily identify the unauthorized or fraudulent activities so that it can be acted upon promptly before any major losses incurred.

- Maintain Awareness of Spending Habits: Monitoring your account balance assists you in recognizing your spending habits so that you can be able to better budget and practice financial management.

- Verify Accuracy of Transactions: A review of your account enables you to ascertain that deposits and withdrawals of all your transactions are properly recorded thus ensuring that your financial records are correct.

- Enhance Financial Security: Being attentive to your account and monitoring it regularly will allow you to raise an alarm and eliminate the discrepancies in the most prompt way, which will also enhance your general financial security and peace of mind.

Checking on the balances regularly is one of the best practices that can effectively enable one to manage his or her finances and achieve long-term financial stability.

How to Register for FAB Online Banking In UAE?

Registering for First Abu Dhabi Bank (FAB) Online Banking is quick and easy. With online banking, you can check your balance, transfer money, pay bills, and manage your finances from anywhere.

To access FAB’s online banking portal, you need to register Follow these simple steps to register:

- Visit the Website: Go to www.bankfab.com and click “Login.”

- Select Register: Choose “Register for Online Banking.”

- Enter Details: Provide your customer ID, card number, or Emirates ID.

- Verify Identity: Complete the verification process via a one-time password (OTP) sent to your registered mobile or email.

- Create Credentials: Set a username and password.

- Log In: Use your credentials to access the portal.

Requirements: A FAB account, Emirates ID, and registered mobile number or email.

How to Reset FAB Online Banking Password

Forgot your FAB online banking password? Reset it easily:

- Online Reset:

- Visit the FAB Online Banking Login page.

- Click ‘Forgot Password’ or ‘Unlock Account.’

- Enter customer ID or card number.

- Verify identity and create a new password.

- Phone Reset: Call 600 52 5500 → Request password reset → Follow instructions.

How to Use the FAB Mobile App?

The FAB Mobile App is a powerful tool for managing your finances. Here’s a quick guide to get started:

- Download and Install: Get the app from the App Store or Google Play Store.

- Register:

- Open the app and select “Open a New Account” or “Log In.”

- Enter your customer ID, card number, or scan your Emirates ID.

- Complete facial recognition or OTP verification.

- Explore Features:

- Check balances and e-statements.

- Transfer funds or pay bills.

- Activate cards or freeze them if lost.

- Set up balance alerts.

- Secure Login: Use Fingerprint or Face ID for quick access.

Key Benefits of the FAB Bank Balance Check on Mobile App

B Mobile App stands out for its versatility and user-friendly features:

- Real-Time Access: View balances and transactions instantly.

- Convenience: Manage accounts, pay bills, and transfer funds without visiting a branch.

- Security: Fingerprint and Face ID ensure safe access.

- Rewards Tracking: Monitor FAB Rewards and cashback offers.

- Multi-Account Management: Handle savings, credit cards, and prepaid cards in one place.

- International Transfers: Send money to over 200 countries instantly.

How to Check FAB Credit Card Balance

To check your FAB credit card balance:

- FAB Mobile App:

- Log in and go to the “Cards” section.

- Select your credit card to view the balance and recent transactions.

- Online Banking:

- Log in to www.bankfab.com.

- Navigate to “Cards” to see your credit card balance.

- ATM:

- Insert your credit card into a FAB ATM and select “Balance Inquiry.”

- Phone Banking:

- Call 600 52 5500 (UAE) or +971 2 6811511 (international) and verify your identity.

- SMS Banking:

- If registered, send “BAL” followed by the last 4 digits of your credit card to 2121.

How to Pay FAB Credit Card Bills

Easily pay your credit card bill using these options:

- Mobile App: Open FAB App → Go to ‘Payments’ → Select your card → Enter amount → Confirm.

- Online Banking: Log in → Navigate to ‘Payments’ → Select your card → Enter details → Confirm payment.

- ATM: Insert FAB debit card → Select ‘Credit Card Payment’ → Follow instructions.

- FAB Branch: Visit any FAB branch → Provide card details → Make payment.

FAB Balance Check Errors & Fixes

Common issues and their solutions include:

| Sr. | Errors | Explain | fixes |

| 1 | App Login Failure | App crashes or displays “under maintenance. | Update the app, clear cache, or try again later. Contact support via “Help & Support. |

| 2 | Incorrect Balance Displayed | Balance doesn’t reflect recent transactions. | Wait for transactions to clear or check via another method (e.g., ATM). |

| 3 | SMS Not Received | No response to SMS banking request. | Ensure your mobile number is registered. Contact FAB at 600 52 5500. |

| 4 | ATM Card Rejection | Card not recognized or confiscated. | Contact FAB to report the issue and request a replacement card. |

| 5 | Online Banking Access Denied | Invalid credentials or locked account. | Use the “Forgot PIN” option or contact support to reset credentials. |

FAB Customer Support

First Abu Dhabi Bank (FAB) provides comprehensive customer support to assist you with your banking needs. Here’s how you can reach them:

- Official Website: https://www.bankfab.com/

- Headquarters: Abu Dhabi in Khalifa Business Park

- Phone Support

- Within the UAE: Call 600 52 550

- Internationally: Dial +971 2 6811511

- Email Support: [email protected]

- Social Media Accounts

FAB vs. Other UAE Banks: Balance Check

Checking your bank balance in UAE banks is simple. Here’s a quick comparison:

| Bank | Mobile App | Online Banking | ATM Check | SMS Banking | Phone Banking |

| FAB | Yes | Yes | Yes | Yes | Yes |

| ENBD | Yes | Yes | Yes | Yes | Yes |

| ADCB | Yes | Yes | Yes | Yes | Yes |

| DIB | Yes | Yes | Yes | Yes | Yes |

FAQs

Conclusion

Viewing your FAB bank balance has never been easier with a variety of methods on offer including the FAB Mobile App, active and text-based banking and branch visits. Monitoring your balance regularly can help you prevent the occurrence of overdrafts, keep track of your spending and manage your finances easily.

FAB Mobile App is the most convenient approach, providing the real-time connection and safe log in and has some more opportunities such as the possibility to pay bills and surveillance of rewards. FAB guarantees an uninterrupted service to international users and users of Ratibi cards as far as global ATMs and digitalization. Sign up to the online banking or the FAB Mobile App today to become the master of your own financial journey at the First Abu Dhabi Bank.